Regulated by the Reserve Bank of India (RBI) under the RBI Act of 1934, Non-Banking Financial Companies (NBFCs) typically offer higher interest rates on fixed deposits (FDs) compared to banks due to the credit risk associated with them.

- Advertisement -

However, it’s important to note that pursuing higher interest rates without considering safety can lead to defaults and repayment delays. Therefore, it’s advisable to invest in FDs that have received the highest safety ratings from reputable credit rating agencies.

Here’s a list of prominent NBFCs offering competitive fixed deposit interest rates for senior citizens:

Bajaj Finance FD Interest Rates

Bajaj Finserv provides attractive interest rates ranging from 7.70% to 8.60% for non-cumulative deposits for senior citizens. This special deposit offer is applicable for deposit tenures between 15 months and 44 months. For regular deposits, senior citizens can avail interest rates ranging from 7.65% to 8.30% across different tenures.

Muthoot Finance FD Interest Rates

Muthoot Finance offers an annual interest plan named “Muthoot Cap” for non-cumulative deposits, with interest rates varying from 6.25% to 7.25%.

- Advertisement -

LIC Housing Finance FD Interest Rates

LIC Housing Finance extends interest rates of 7% to 7.75% on non-cumulative deposits up to Rs. 20 crore. For cumulative deposits, the interest rates range from 7.25% to 7.75%. The minimum investment amount required is Rs. 20,000.

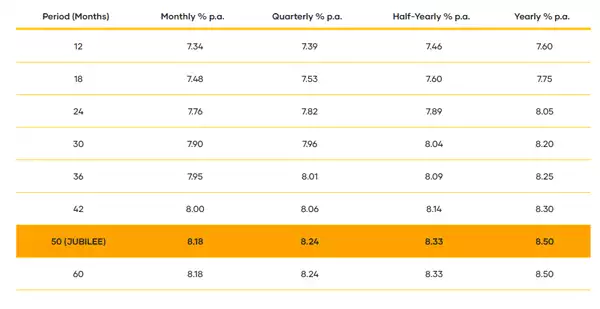

Sundaram Finance FD Interest Rates

Sundaram Finance offers fixed deposit interest rates for senior citizens are between 7.95 % to 8.25 % at annual rests.

ICICI Home Finance FD Interest Rates

ICICI Home Finance senior citizens fixed deposit (FD) interest rates ranging from 7.25% to 7.75% under a yearly income plan for non-cumulative deposits. For special deposits, the interest rates range from 7.65% to 7.85% for senior citizens in the non-cumulative deposits under the yearly plan.

Non-Cumulative FD vs. Cumulative FD

In a non-cumulative FD, earned interest is disbursed according to your choice of regular periods, whether monthly or quarterly. On the other hand, a cumulative FD is preferable if you wish to build a corpus for short- or long-term goals. If consistent income to cover ongoing expenses is your requirement, then a non-cumulative FD is more suitable.

According to Axis Bank, “Keep in mind that while a cumulative FD offers higher interest returns due to compounding, the interest is paid out at the end of the tenure. In contrast, non-cumulative FDs provide regular income through periodic interest payouts.”

Article Source and Credit :- Economic Times