Warning: Undefined array key 0 in /home/u347405708/domains/bimaloan.in/public_html/wp-content/plugins/ad-inserter/class.php on line 8208

Warning: Undefined array key 0 in /home/u347405708/domains/bimaloan.in/public_html/wp-content/plugins/ad-inserter/class.php on line 8208

UPI-ATM : India’s financial landscape has been reshaped by the introduction of the UPI-ATM, a groundbreaking innovation launched by Hitachi Payment Services in partnership with the National Payments Corporation of India (NPCI).

- Advertisement -

Unveiled during the Global Fintech Fest in Mumbai on September 5, this cutting-edge technology offers secure cardless cash withdrawals, ushering in a new era in digital banking. Let’s delve deeper into the intricacies of this revolutionary UPI-ATM.

Understanding the UPI-ATM .

- The UPI-ATM is a white label ATM specially designed to facilitate cardless cash withdrawals.

- It empowers customers of participating banks to access cash without relying on traditional ATM or debit cards.

- Notably, white label ATMs are owned and operated by non-bank entities, introducing diversity into the banking landscape.

How Does the UPI-ATM Operate ?

- Users initiate the process by selecting the ‘UPI cash withdrawal’ option at the ATM and specifying the desired withdrawal amount.

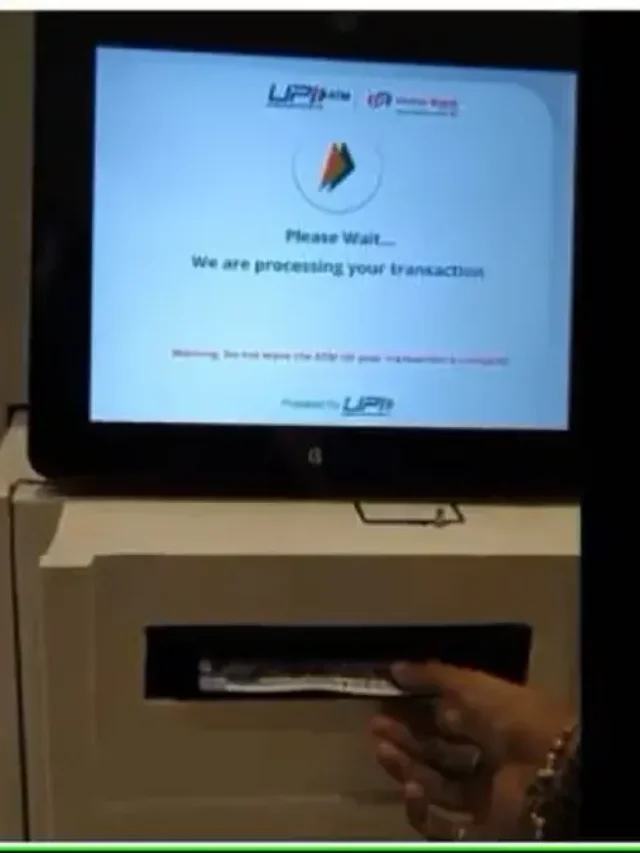

- Subsequently, a unique dynamic QR code is displayed on the ATM screen.

- Customers can scan this QR code using any UPI app and complete the transaction by entering a PIN on their mobile app.

- Once validated, the UPI-ATM promptly dispenses the requested cash.

Key Features of the UPI-ATM Service.

- Offers an interoperable, cardless transaction facility, revolutionizing cash access methods.

- Implements a withdrawal limit of Rs 10,000 per transaction, in accordance with the daily UPI limit and specific caps set by issuer banks for UPI-ATM transactions.

- Eliminates the need for physical cards during ATM cash withdrawals, granting users the flexibility to withdraw funds from multiple accounts via the UPI app.

UPI ATM vs. Cardless Cash Withdrawals.

- The UPI ATM experience parallels the convenience of cardless cash withdrawals offered by several banks.

- While cardless cash withdrawals rely on mobile devices and OTP (One-Time Password), the UPI ATM utilizes QR codes for seamless cash access.

Public Response to the UPI ATM.

- Anand Mahindra, Chairman of the Mahindra Group, shared a video illustrating the UPI ATM’s functionality, lauding India’s swift digitization of financial services with a focus on consumers.

- Praveena Rai, COO of NPCI, highlighted the transformative potential of UPI ATMs in redefining the ATM experience, encompassing factors like cost, location, and accessibility.

- The UPI ATM has received acclaim at the Global Fintech Fest in Mumbai, showcasing its capacity to revolutionize traditional banking services.

Conclusion: The UPI ATM marks a pivotal moment in India’s banking sector, seamlessly blending the security and convenience of UPI with traditional ATM services. As India continues its digital evolution, innovations such as the UPI-ATM are driving financial services toward a more consumer-centric and efficient future.